My Five Cents Worth.

The first time I realized the bank (FirstChicago at the time) wasn't as interested in relationships is when they instituted a charge for making a deposit with a teller. That's right, if I wanted to deposit a check, they wanted me to use the machine or the night drop. Since cash wasn't optimal in a night drop, there was no fee for making a cash deposit with a teller. So being indignant about being charged for service from a service industry, I would deposit checks and a nickel. No teller fee when cash was part of the deposit. I pissed off a lot of tellers, but I guess I wasn't the only one. Within six months, the teller fee was dropped.

New Fees?

You Can Bank On It.

The banks are at it again. Bank of America has announced that beginning next year they will charge $5/month for the privilege of a debit card. That's $60 a year for access to your money. Bank of America won't be the only bank to institute this charge. JP Morgan Chase and Wells Fargo are already testing $3/month debit card fees in certain markets.There are many reasons for this renewed emphasis on more fees. It could be that the big banks upper level management are money grubbing whores that can't start burning in hell next to Milton Friedman soon enough for my tastes, but that would be a political statement and I intend to avoid politics on this blog. The fact is, banks don't really make their money by paying interest on deposits and loaning out the deposits at a greater rate. Banks make more money on fees and investments. There is also less competition in the bank industry over the last decade via consolidations. My mother can no longer call her local banker (Bank of America owns her neighborhood bank) for service, she has to call a toll-free number. For my mother that doesn't see or hear well and doesn't own a computer it is a very sad situation.

| ||||

| Source: Wikipedia |

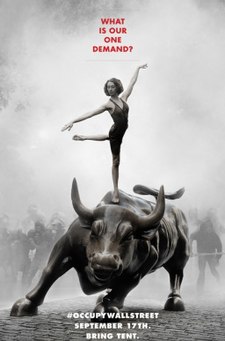

Occupy Your Thoughts.

There aren't any easy answers (there never are) but I there is one thing I know. If I choose to suffer in silence, I can only look forward to more (and larger) bank fees. There are some people objecting to this bank over reach as well as other bank bad behavior. You may have heard something about Occupy Wall Street. Occupy Wall Street is growing and organizing locally. I realize that it's not so easy to march around with signs once you have a house, family, job etc. I agree. But sometimes a bunch of small gestures add up to a large gesture. My nickel's worth with other peoples actions got teller fees eliminated. Maybe together we can work on the debit card fee and other fee frustrations. Do nothing and the message is the fees are just fine.How do you feel about being charged a monthly fee for a debit card? Is it just the coast of doing business? Do you have any ideas on how to share your feelings with the big banks?

Stop banking with any bank that increases their fee! Look for a credit union or other bank with lower fees. The only way to hurt them is to take business away from them.

ReplyDeleteThanks for stopping by. You're right about banking local, but for a multitude of reasons, not everyone can bank locally. Also, the big banks aren't that interested in small accounts. Finally, it's important for lawmakers to see public pushback toward the banks. It lets legislators know that after the banks, they're next. Thanks for stopping by. I would love to have a name associated with such a cogent comment.

ReplyDelete